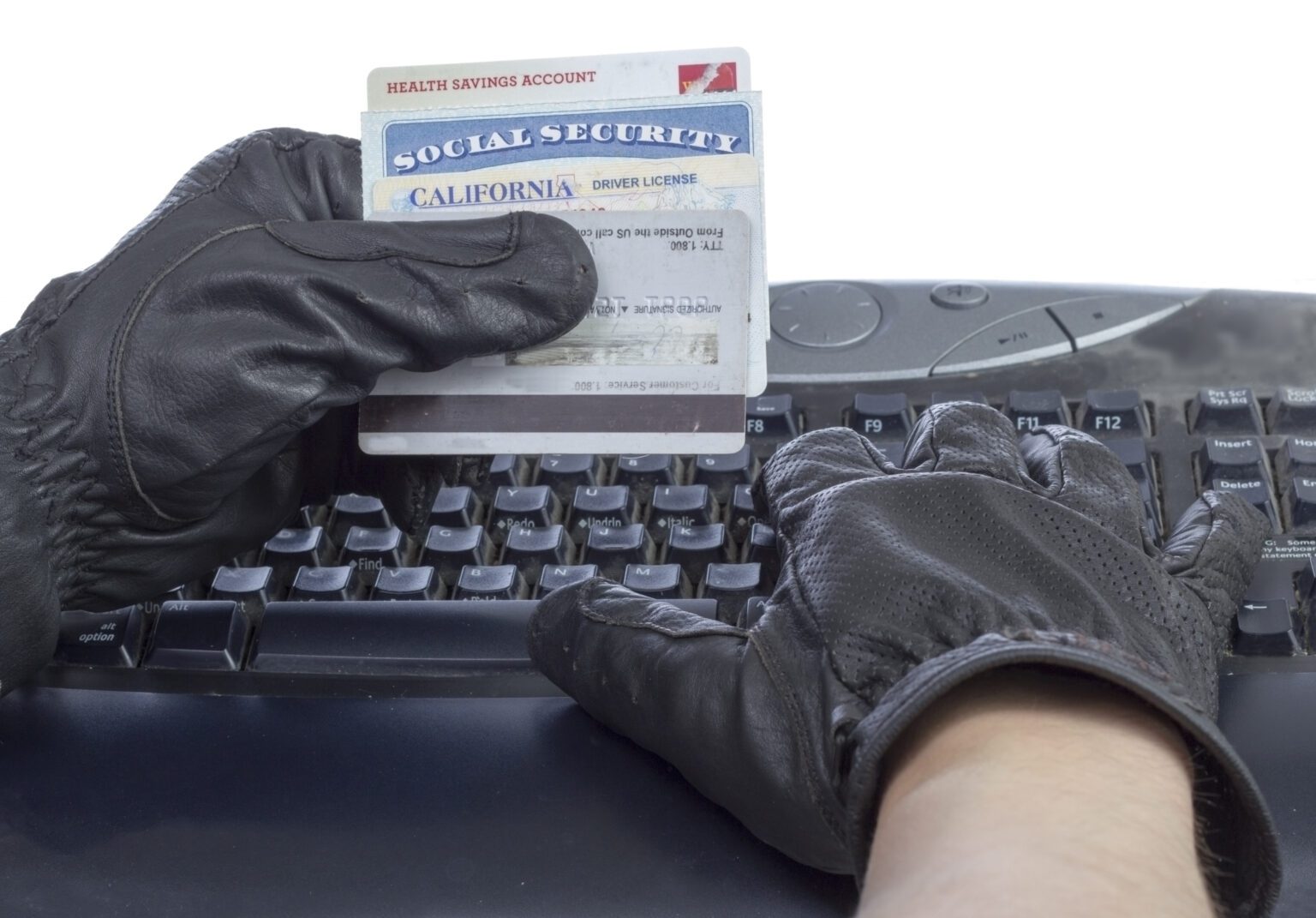

Since 2020, when many services went online during the COVID-19 pandemic, identity theft has increased rapidly. Identity theft is when someone steals your personal information and uses it for their own purposes and gain. This information can include your bank logins, your checking account, your credit card details, access to your email, and any government ID numbers.

Since 2020, when many services went online during the COVID-19 pandemic, identity theft has increased rapidly. Identity theft is when someone steals your personal information and uses it for their own purposes and gain. This information can include your bank logins, your checking account, your credit card details, access to your email, and any government ID numbers.

International citizens are especially vulnerable to identity theft. Why? You are using online services more: to manage your finances, work or study, and connect with friends and family. While you travel, you may need to access these services with less IT security, such as on unsecured WiFi in an airport, or in locations where people can see your screen.

Financially, you may also be managing multiple bank accounts and emails, for your home country and the country where you live. And your citizenship information for your country of origin, like your passport or national ID, has value for criminals or scammers. Even your social media feed can be hacked and abused.

Luckily, there are several ways to protect your personal information while living and traveling abroad. This article offers essential tips on how to prevent identity theft during your time overseas.

Get our monthly newsletter filled with tips and information for people living, moving, and traveling outside of their home country.* *By submitting your email, you agree to receive monthly updates for expats, digital nomads, retirees, and more.

Identity Theft Is a Global Problem

Wherever you are in the world, you need to be aware of identity theft. There is no place that is safe from identity theft today, and the problems around it are growing.

Is Identity Theft a Problem in the US?

The United States is the world’s capital of identity theft, with the largest number of stolen identities. Nearly 50 million people in the US have had to deal with identity fraud, according to the National Crime Victimization Survey. In the US, much of this is related to credit card fraud and government benefit fraud. Both of these increased by more than 50% from 2020 onwards.

Is Identity Theft A Problem in Europe?

Identity theft is also prevalent in Europe. A study by the Swedish currency service group Finanso.se found that one in five Europeans have experienced identity theft. Some people think of Europe’s English-speaking countries as safe. Yet the United Kingdom and Ireland reported the highest levels of identity theft between 2021 and 2023.

Does Identity Theft Happen in Other Countries?

Identity theft happens around the world. Expats living globally may be vulnerable as they negotiate emails and messages in a new language. Again, countries that are perceived as safe places, like Canada, South Korea, and Japan, are among the 10 countries with the highest per capita occurrences of identity theft. The more a nation’s citizens rely on technology, the more at risk they are of identity theft.

What Is the Number One Cause of Identity Theft While Abroad?

“Phishing” text messages and emails are the most common gateway to identity theft. In these communications, panic-inducing messages encourage people to click on insecure links or to share logins. That’s how texts and emails “fish” for your identity information. Victims of cell phone or mobile scams often report being upset about an “emergency” message that looks familiar and then clicking on a link too quickly.

Who Is Most At Risk for Identity Theft?

Surprisingly, younger people are at more risk. That’s because they use more online services. In the US, 40% of the victims of identity theft are 20 to 39 years old. There are very young victims of identity theft, too: children under 18. Their clean credit records make them attractive to identity thieves seeking IDs they can use for loans, bad checks, and other fraud.

When identity theft strikes older people, it can have serious consequences. Older people lose more money in each incident than younger people do – an average of $1,300. The stress of undoing identity theft affects both older people and their families, who are often called on to help. In the worst cases, these thieves can drain retirement funds and bank accounts.

Also Read: 12 Tips for Staying Safe While Traveling

Be Aware of Synthetic Identity Theft

In synthetic identity theft, a fraudster uses one or two pieces of your information, such as a Social Security number or birth date, to create a new identity. When a real ID number supports a false identity, it can be hard to detect, and useful for financial fraud. If you are living outside your home country, and not monitoring your credit history closely, you are at risk of synthetic identity fraud.

Romance Scams and Identity Theft

Having your social media hacked may seem minor, but beware! If you’re living abroad, you need to know about identity theft for impersonation. This is called misappropriation of likeness – and it’s often used in romance scams.

Romance scams involve several types of identity theft. In a romance scam, a thief sets up a profile on social media and pretends to be somebody they’re not. They use this false identity to create relationships online. Then, once someone is invested in them, they ask for money.

International citizens may be at risk of having their likenesses misappropriated to support a romance scam. Your photo, name, and social media profiles might be hijacked to create a credible front for someone looking to profit from your identity. Scammers may pose as a military hero stationed overseas or as a friendly travel blogger at your location. It can be very difficult to stop this misuse of your likeness, especially if you live internationally.

What Best Protects You From Identity Theft?

There are several ways to safeguard your personal information while living or traveling overseas. Here are some steps on how to prevent identity theft while spending time abroad.

Use an Identity Protection Service

If you need help protecting your finances and identity, you might want to consider using an identity protection service. For a fee, these services provide credit monitoring, safeguards, and tools for online security.

However, not all identity protection services cover people outside the U.S., so you should check with their customer service to see if they provide coverage in your country. Alternatively, you could use one of the following services that offer international coverage:

- Bitdefender

- NortonLifelock Worldwide

- McAfee+ Identity Protection

- IdentityForce

- Experian IdentityWorks

Again, be sure to check if these services cover your destination.

Protect Your Identity Online

The best way to protect yourself from identity theft is to be careful with your online data and keep your personal information secure.

Protecting yourself from identity theft might mean adding a few extra steps to how you handle your accounts and transactions, but the extra security is worth it. Here are some tips to help you:

- Set up every security option for your online accounts, including ones that access your finances and international identity. Learn how to use these – get confident with them.

- For everything you do online, even social media, have secure passwords that you remember. Passphrases are hard for others to guess and provide good security while being memorable.

- If your bank offers two-factor authentication, use it. Two-factor authentication will ask you for another verification before you access your account or send money.

- Lock your phone, laptop, and tablet with passwords and PIN numbers.

- Avoid using public Wi-Fi networks, or computer terminals in hotels or hostels, wherever possible. Your data can be intercepted.

- For extra security in your overseas life, you can sign up for an identity theft protection service online. Check out identity protection services from software companies like McAfee and Norton, and ID specialists like Aura, IDX Complete, and IDShield.

Use a VPN

A VPN is an excellent way to protect your online identity, especially if you’re traveling and you have to use less secure networks.

VPN stands for virtual private network. It protects you by sending your online activity through a layer of encryption. You can set a VPN’s location to mirror your home country, and you can use VPNs on your smartphone as well as on laptops and tablets. There is usually a small monthly charge for a VPN, from $2 to $5. The added virtual security is worth it. Almost all fraud protection services provide a secure VPN for you to use.

Enhance Your Physical Protection

It’s easy to boost your physical security around your ID and finances. Protect yourself as you travel and in your daily life overseas with these tips.

- Only carry the ID and financial cards you need in your wallet. For everyday life, you may just need a local driver’s license, a bank card, and one credit or debit card. Store other cards securely, including overseas driver’s licenses, extra credit cards, and Social Security or other ID cards.

- Keep your passports secure, too. Again, in your everyday life, you don’t need to have your passport with you all the time. Passports are valuable to thieves.

- Your car is not in a secure location! Don’t leave wallets, bags, letters, or anything with ID value in your car when you’re not there.

- When you’re out and about, only take your cards out when you are using them, briefly and securely. Be careful around ATMs that are not bank ATMs, especially in tourist areas. And be careful with your phone, too. Don’t share your phone with other people, under any circumstances.

- At home, watch out for what you throw out. If you get letters with financial or immigration information, when you are done with them, shred them or destroy them. That way, your details won’t get stolen when you throw the letters away.

Find the Best International Insurance

- Compare multiple quotes and coverage options

- Work with an insurance expert at no additional cost

- Find the best plan for your needs and budget

How Can I Find Out If Someone Is Using My Identity?

Identity theft is deeply inconvenient for expats and people living internationally. You have to work in two or more countries to resolve the problem. The steps below can protect your identity if you think your personal security has been compromised.

Can I Check If Someone Is Using My Social Security Number?

There are ways for a US citizen to check if your Social Security Number is compromised. The US Social Security Administration encourages you to:

- Check your official Social Security Statement – unusual activity will show up at your online Social Security account

- Order and review a free credit bureau report – use the Annual Credit Report Request Form or call 1-877-322-8228

If someone else is using your US Social Security number, report this at the Federal Trade Commission’s Identity Theft page, and contact the Internal Revenue Service.

What To Do When You Find Out Someone Is Using Your Credit Card

Usually, you find out someone else is using your credit card from either a call from the card company or by noticing a suspicious transaction. If your credit card company is in touch with you, you’re in luck. They have already identified that the transactions are fraud, and they will work with you to resolve this.

What if you are the one who has noticed? Check your account for other unusual transactions to see if there is a history of this. Then, contact your credit card company and go through their fraud process.

How to Prevent Someone From Opening a Credit Card in Your Name

When you’re living outside of your home country, there’s another identity risk: somebody opening a credit card in your name.

To prevent someone from opening a credit card in your name, freeze your credit report. This prevents people from creating new accounts with your identity. If you’re from the US, you must freeze your credit report with the three main US credit bureaus, Equifax, Experian, and Transunion. From the UK? Contact CIFAS, the UK’s Fraud Prevention Service, and sign up for protective registration. When you do, CIFAS will carry out extra checks if anyone applies for a financial service using your address or ID.

Check, Report, and Learn More

For a free identity theft check while living overseas, or support if you think your identity has been stolen, try these resources. You may also need to search for identity theft organizations in the country where you are living. If you are living internationally, report your identity theft in all the countries where you have lived, or where you maintain bank accounts.

- IdentityTheft.gov – United States

- ActionFraud, National Fraud & Cyber Crime Reporting Centre – United Kingdom

- FraudSMART.ie – Ireland

- Canadian Anti-Fraud Centre – Canada

- ID Care – Australia and New Zealand

It’s difficult to know how to avoid identity theft when living or traveling abroad, but with strong security measures, you can reduce the risk. Acting quickly at any signs of identity theft can also help minimize its impact.

Related Articles: